Office Leasing Diverges This Year

- Private Investment Team

- Jul 30, 2025

- 3 min read

As recovery in demand surges in some markets, the first-half gap between high and low performers widens

By Phil Mobley

CoStar Analytics

July 10, 2025 | 7:33 AM

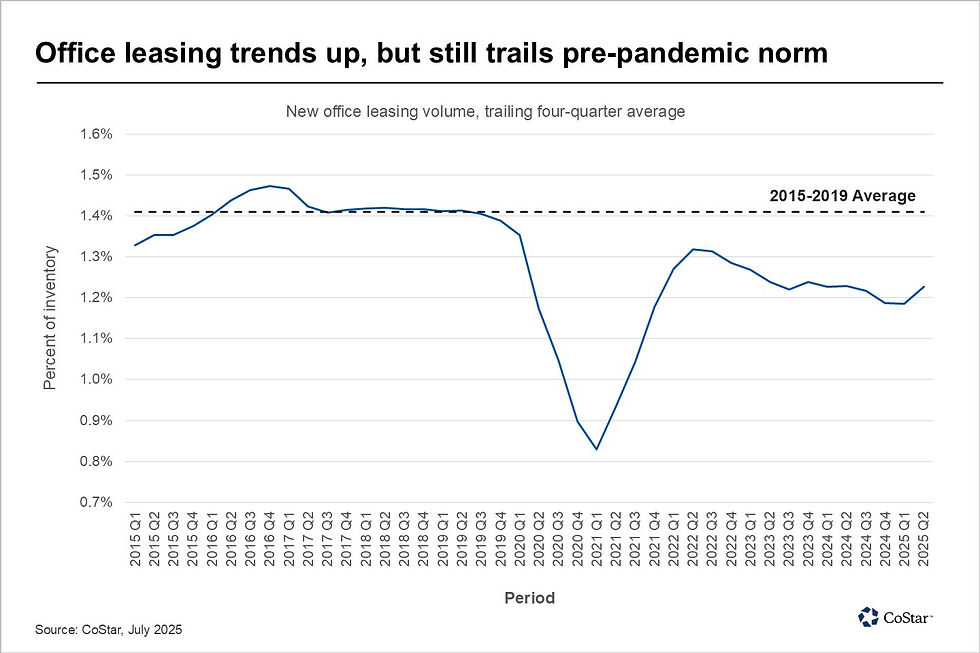

Office leasing activity edged higher in the first half of the year, though overall leasing volume remains stubbornly below its typical level from the late 2010s. While a few markets appear to be in full-blown recovery, others are still off the pace, hampered by both tepid demand and the absence of large blocks of available premium space.

Tenants executed new lease agreements for an estimated 220 million square feet in the first six months of 2025, a substantial increase from the approximately 195 million inked in the second half of 2024. Still, the first-half total trails the 230 million square feet that was typically leased over a given six-month period between 2015 and 2019.

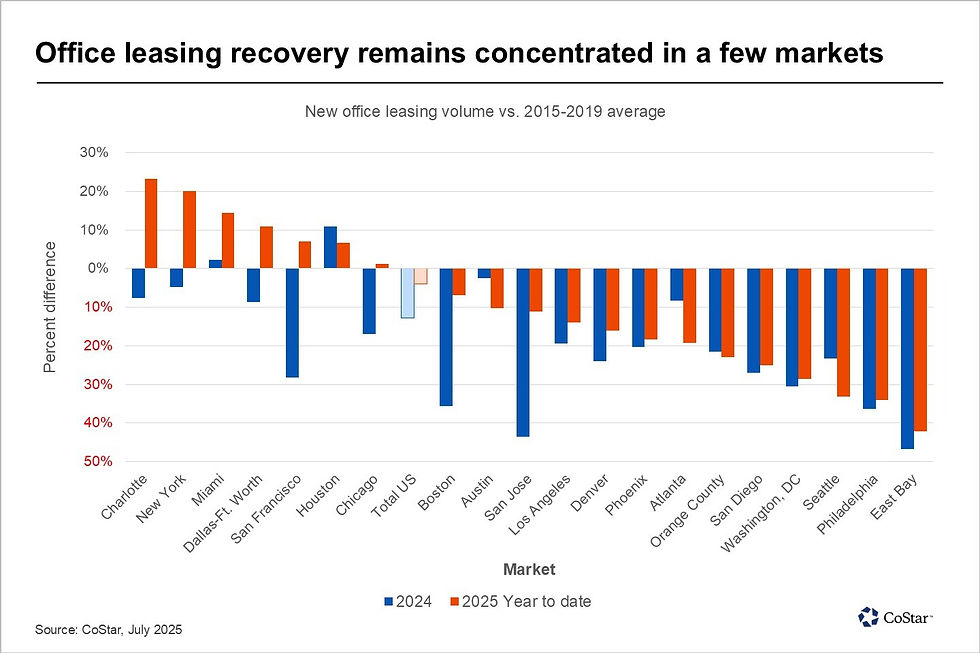

Year-to-date leasing performance varies widely across the nation’s largest office markets. Increased hiring and a renewed focus on in-office work by financial institutions have catalyzed a robust leasing recovery in New York, with volume 20% higher than its customary pre-pandemic level.

Similar trends have benefited Charlotte, North Carolina’s office market, while strong population demographics and a comparatively robust delivery pipeline have underpinned robust office leasing in both Miami and Dallas.

The tech sector, led by AI-focused companies, has also contributed, boosting leasing activity on the West Coast. Volume in San Francisco is up 7% from its pre-2020 average so far in 2025 after being down nearly 30% in 2024. San Jose has also seen a meaningful increase in leasing activity over 2024, though not yet back to its late-2010s level.

In most other markets, however, office leasing activity remains stunted, and the composition of the market is one key factor.

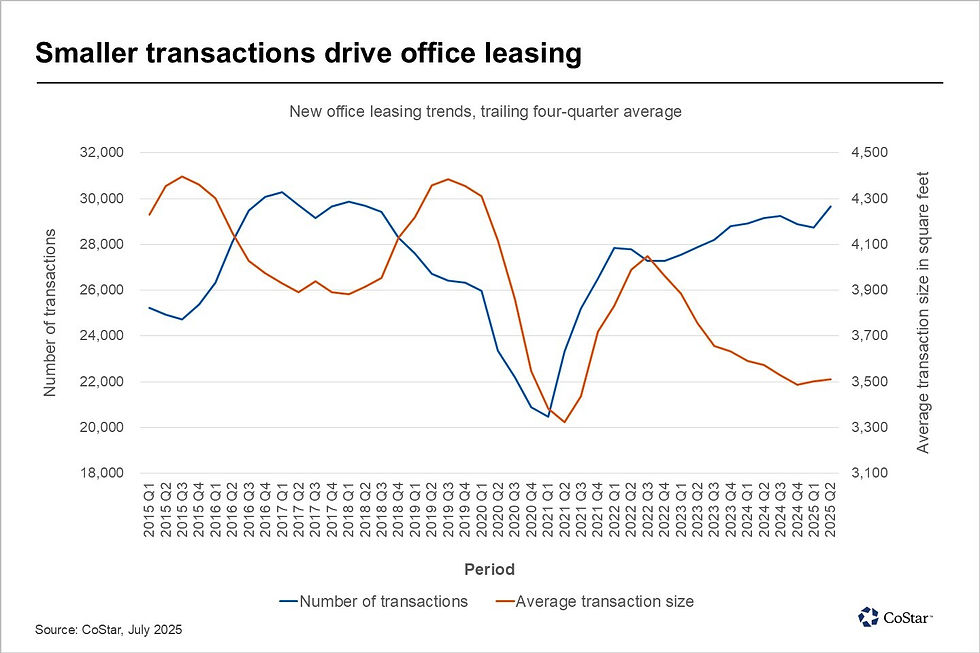

The recent trend of smaller lease sizes shows no sign of reversing, with the typical office lease remaining 15% to 20% below its pre-pandemic average. Though slow job growth is a major factor on the demand side, the supply side is becoming increasingly important to the office market's dynamic.

As completions of new office space slows inexorably due to reduced construction activity, large occupiers have fewer opportunities to upgrade into first-generation space. With slow payroll growth currently presenting little pressure on office tenants to expand, many appear to be staying in place, renewing existing leases and waiting patiently for future construction activity to present them with relocation options in a few years.

Smaller tenants, meanwhile, look to be capitalizing on this situation by filling in the remaining available spaces in the most desirable locations and buildings. Until the office pipeline ramps back up, the trend toward smaller leases is likely to persist.

All content provided on this blog is for informational purposes only. The owner of this blog makes no representations as to the accuracy or completeness of any information on this site or found by following any link on this site. The owner of will not be liable for any errors or omissions in this information nor for the availability of this information. The owner will not be liable for any losses, injuries, or damages from the display or use of this information.

Keywords: San Diego Commercial Real Estate For Sale, Commercial Property In San Diego, Commercial Real Estate In San Diego, San Diego Investment Real Estate, Commercial Property Management In San Diego, San Diego Commercial Property Management, Commercial Property Management San Diego, Managed Commercial Property San Diego, Commercial Property For Sale San Diego, San Diego Commercial Real Estate Leasing, Top Real Estate Agents in San Diego, Commercial Property in San Diego, Property Management

Comments